navigation

Data portal for financial managers and investors

the background

Our client was a financial management company which provided CFO and fund administration services to venture capital funds and their portfolio companies. Their services included providing quarterly fund and LP reporting, audit/tax management, financial modeling/forecasting, LPA compliance, and management company operations.

roles

UX design / Wireframes

THE PROBLEM

Our client used Excel to manage their client database and to track all financial transactions. As the company expanded, our client needed a tool to help them streamline their new client onboarding process and financial transactions, while allowing their clients to manage their portfolios.

the pain points

In mapping out the relationships between different user profiles (Fund Administrator and Limited Partner) and our client's current workflows, we identified the following pain points:

A lot of their clients were involved in multiple funds, which meant their information was cross-referenced at different points in our client's processes. Therefore it was important that stored data was easily accessible and not duplicated.

Our client often did not have all of their client's information during onboarding. They needed a system where they can update information without getting lost in the complex database.

Our client manually requested funds from their clients via email. They wanted to automate the process and to securely track all transactions.

HOW MIGHT WE

DESIGN NEW AND IMPROVED WORKFLOW EXPERIENCES THAT WERE EASY TO LEARN, WHILE SIMPLIFYING THE DATA MIGRATION PROCESS FROM EXCEL?

the products

As the UX designer for this project, I was in charge of designing a data portal for 2 user profiles:

The Fund Administrator User (for financial managers)

The Limited Partner User (for investors)

“No more Excel - we want to excel!”

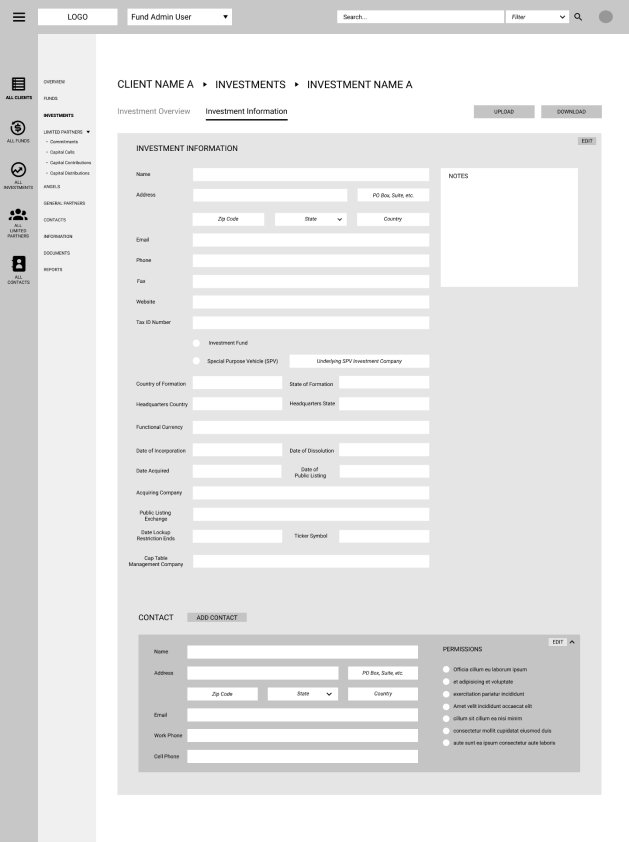

Through in-depth user interviews, we learned the Fund Administrators used Excel to log new contact information to jumpstart the fund distribution process. Then they continued to add more details as their clients provided.

To streamline this process, we compiled an editable form for new contacts. Users could upload data from Excel to fill in the form and manually input data as needed. By enabling auto suggestions based on previous data input, users could know if the data was already stored in the database. This feature prevented replicated data and helped accelerate the data input process. Once the new contact was added, it functioned as a Client Profile, where users could add more data and documents pertaining to that client.

New client onboarding form

Stop digging through the files!

Our client's current workflow involved switching between massive Excel files to gather and updated data, which required long loading time and sometimes crashed their computers!

To solve this problem, we incorporated an overview page for each menu item, so that users did not have to dig through massive amount of data to find what they need. These overview pages also helped generating reports, which were distributed to the Limited Partners portal and were vital parts of the fund transaction process.

Fund Admin User - Limited Partner information

From “Did you get my email?” to “Thanks for uploading your docs!”

A major component to the portal was generating fund requests from Limited Partners (“Capital Calls"), which was traditionally done via email by Fund Administrators. Doing so required users to record and track transactions separately, which became more cumbersome as the accounts (and the company!) grew.

Our solution was to allow Fund Administrators to upload requests under each contact's profile. Once uploaded, these documents could be made available immediately on the Limited Partner portal. All transaction history was stored under each client profile, which helped with record keeping and generating reports.

Capital Call schedule on the Limited Partner user profile